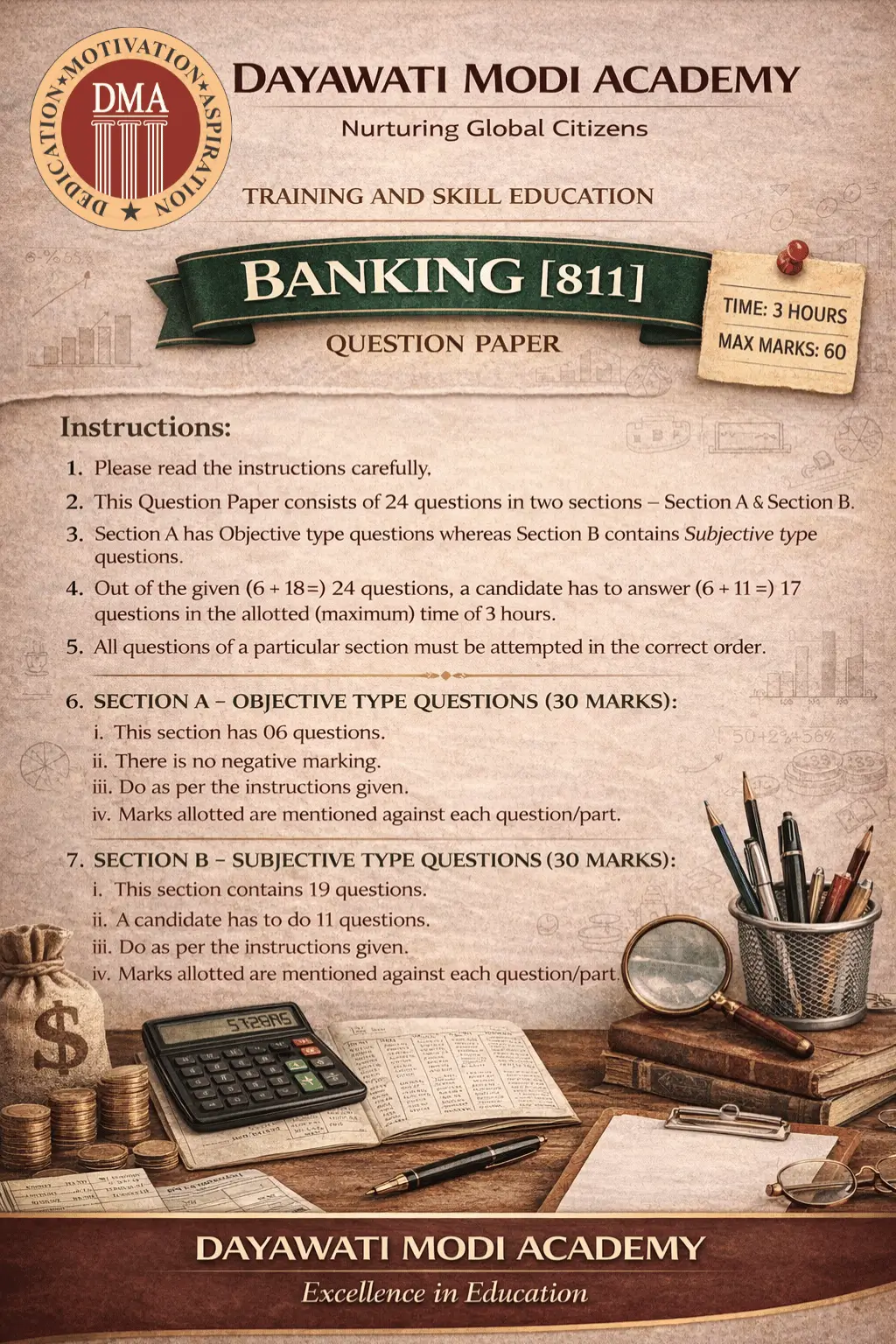

PRACTICE QUESTION PAPER

BANKING [811]

SECTION A – OBJECTIVE TYPE QUESTIONS (30 MARKS)

Q.1

Answer any 4 out of the given 6 questions on Employability Skills

(1 × 4 = 4 marks)

i. _______ term is also referred to self management.

a) Emotions, behavior and thoughts

b) Self regulation

c) Self management

d) All of the above

ii. List two ways of maintaining positive attitude.

iii. Gives you the benefits of enabling you to indulge in your interest or hobbies, gives you a break from stress.

a) Nature walks

b) Yoga

c) Meditation

d) Leisure

iv. The ability to continue to do something, even when it is difficult is called _______.

a) Initiative

b) Organizational skills

c) Perseverance

d) Decisiveness

v. What is Core Banking?

vi. Bar present at the bottom of the desktop is called ________.

a) Status bar

b) Scroll bar

c) Taskbar

d) None of the above

Q.2

Answer any 5 out of the given 7 questions

(1 × 5 = 5 marks)

i. Which mode of funds transfer takes the shortest time to transfer money to the payee?

IMPS (Immediate Payment Service)

ii. __________ is the name of the process of converting black money to white money.

a) Foreign exchange

b) Laundering

c) Money laundering

d) Demonetization

iii. Actual payment of money by one bank to another is known as:

a) Multilateral Netting

b) Clearing

c) Settlement

d) Call money

iv. In case of floating rate loan, borrower will benefit if the:

a) Interest rate remains constant

b) Interest rate in the future is higher

c) Interest rate in the future is lower

d) Interest rate has no bearing

v. Explain the need of Letter of Credit.

vi. Interest collected by the Bank on a loan is for the Bank:

a) Income

b) Expense

c) Liability

d) Asset

vii. Write the full form of IFSC.

Q.3

Answer any 6 out of the given 7 questions

(1 × 6 = 6 marks)

i. Nomination of bank locker once done can:

a) Not be cancelled

b) Be cancelled

c) Not be changed

d) Can be changed

ii. Delivery of banking services to a customer at his office or home by using electronic technology is called:

a) ATM

b) EFT

c) E-banking

d) ECS

iii. Explain two functions of branch manager.

iv. Interest received on debenture held by bank is _________ to the bank.

a) Asset

b) Liability

c) Income

d) Expense

v. What is NPA?

vi. Which of the following is not a function of RBI?

a) Fiscal policy functions

b) Exchange control functions

c) Issuance, exchange and destruction of currency notes

d) Monetary authority functions

vii. Which guarantee gives an assurance that the task will be completed as agreed?

a) Financial Guarantee

b) Bid bond Guarantee

c) Guarantee for Warranty Obligation

d) Performance Guarantee

Q.4

Answer any 5 out of the given 6 questions

(1 × 5 = 5 marks)

i. Officers holding keys to the drill door of the vault are called vault _______.

ii. Define (any two):

a) Phishing

b) Spoofing

c) Skimming

d) Fishing

iii. State the full form of DSA.

iv. State the name of incentive paid to depositors for postponing their other expenditures and keeping their money with the bank.

v. Which policy is related to direct taxes and government spending?

a) Credit Policy

b) Monetary Policy

c) Fiscal Policy

d) Government Policy

vi. State the full form of GAAP.

Q.5

Answer any 5 out of the given 6 questions

(1 × 5 = 5 marks)

i. The document containing the guarantee of a bank to honour bills of exchange drawn on it by an exporter is:

a) Letter of Hypothecation

b) Letter of Credit

c) Bill of Lading

d) Bill of Exchange

ii. Name the input device for feeding data in computer.

iii. ________ is a secure space specially constructed with RCC on all sides.

a) Manager’s Cabin

b) Cash Counter

c) Strong Room

d) Clerk’s Cabin

iv. EMI on a fixed rate loan remains ______ during the tenure of loan.

a) Fixed

b) Changing

c) Increases

d) Decreases

v. Which role does RBI play when it maintains banking accounts of all scheduled banks?

vi. ________ is the commission paid by mutual fund company to agent in the first year.

a) Trail commission

b) Upfront commission

c) Accrued commission

d) Unaccrued commission

Q.6

Answer any 5 out of the given 6 questions

(1 × 5 = 5 marks)

i. Banker lockers are not used for keeping:

a) Cash

b) Jewellery

c) Stock certificates

d) Home deeds

ii. Upward movement in prices in per annum terms is known as ______.

iii. Upon detection of a counterfeit note at the cash counter of a bank branch, the bank will:

a) Return the note to the customer

b) Exchange with a genuine note

c) Deposit in account

d) Impound the note and issue receipt

iv. In case of an overdraft account, interest is charged only on the ______ balance.

Daily outstanding balance

v. The standard rate at which RBI buys or rediscounts bills of exchange is called:

a) Bank Rate

b) Prime Lending Rate

c) Repo Rate

d) Base Rate

vi. An asset remaining as NPA for up to 12 months is known as:

a) Sub-standard asset

b) Doubtful asset

c) Loss asset

d) Standard asset

SECTION B – SUBJECTIVE TYPE QUESTIONS

Employability Skills

Q.7

Distinguish between paranoid and schizoid personality disorders.

(2 marks)

Q.8

Explain why effective communication is important in the banking environment.

(2 marks)

Q.9

What is spreadsheet? How is it useful for bank employee?

(2 marks)

Q.10

Explain how fear acts as a barrier for an entrepreneur.

(2 marks)

Q.11

What are the green banking initiatives of leading public and private banks?

(2 marks)

Q.12

Explain single window system and cheque-drop boxes and discuss their significance.

(2 marks)

Q.13

State three categories of the Main Day Book prepared in a bank branch.

(2 marks)

Q.14

List the functions of back office and front office of a bank.

(2 marks)

Q.15

Write a short note on CRR and SLR.

(2 marks)

Q.16

State two points of difference between BR and MIBOR.

(2 marks)

Q.17

List any three duties of a Branch Manager as third party.

(3 marks)

Q.18

What is Letter of Credit? List any three features.

(3 marks)

Q.19

Distinguish between fixed interest and floating interest on any three points.

(3 marks)

Q.20

Explain CBS (Core Banking System) and its importance based on given case.

(4 marks)

Q.21

“Cyber threats are more dangerous to banks than physical robberies.”

Do you agree? Justify.

(4 marks)

Q.22

Interest comparison between compound interest and simple interest (case study).

(4 marks)

Q.23

Explain monetary policy of RBI and any two of its tools.

(4 marks)

Q.24

Briefly explain any four liabilities of a bank shown in its balance sheet.

(4 marks)

If you want the solutions for this question paper, please fill the form.

We will share the answers with you.